Carrier Reports Third Quarter 2022 Results

Board approves $2 billion share repurchase authorization

- Net sales up 2% versus 2021; organic sales up 8%

- GAAP EPS of $1.53 and adjusted EPS of $0.70

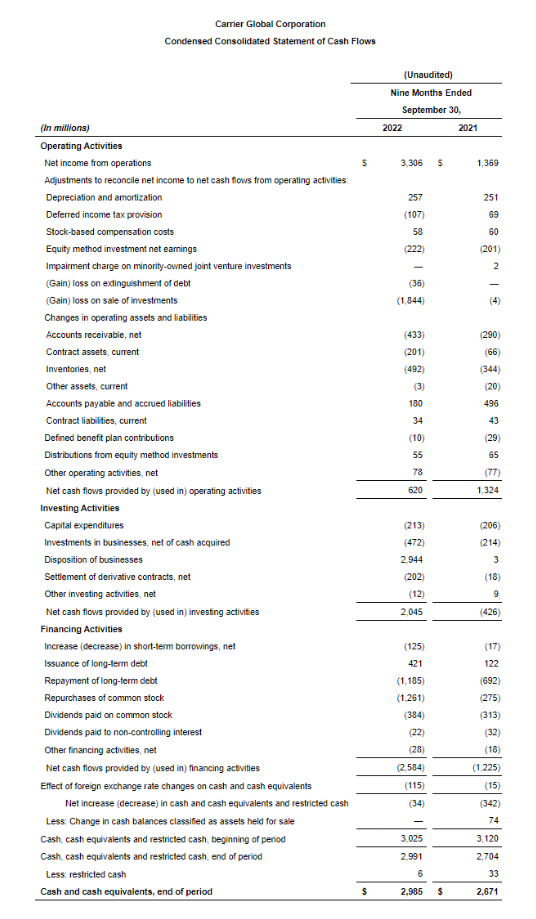

- Net cash flows from operating activities of $790 million; free cash flow of $699 million

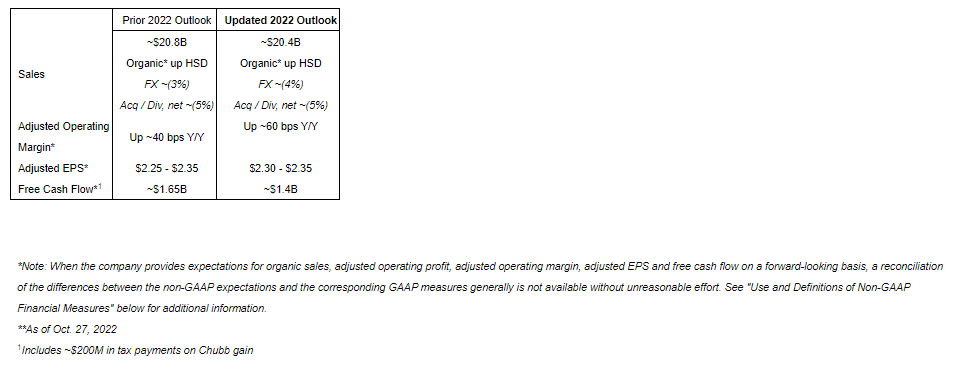

- Updating 2022 adjusted EPS* guidance range to $2.30 to $2.35 from $2.25 to $2.35

- Updating 2022 free cash flow* guidance to ~$1.4 billion from ~$1.65 billion

- Carrier's Board authorizes $2 billion share repurchase program

PALM BEACH GARDENS, Fla., Oct. 27, 2022 /PRNewswire/ -- Carrier Global Corporation (NYSE: CARR), the leading global provider of healthy, safe, sustainable and intelligent building and cold chain solutions, reported another quarter of strong financial results and updated its full-year adjusted EPS outlook to the high-end of its prior guidance.

"Carrier delivered another strong quarter," said Carrier Chairman & CEO David Gitlin. "Our continued focus on innovation and digitally enabled lifecycle solutions provides differentiated outcomes to customers and positions us to benefit from compelling secular trends. Our strong aftermarket growth through the first nine months of the year further strengthens the resiliency of our business model. Our new share repurchase authorization demonstrates our confidence in Carrier's long-term strategy and commitment to delivering shareholder value through disciplined capital allocation."

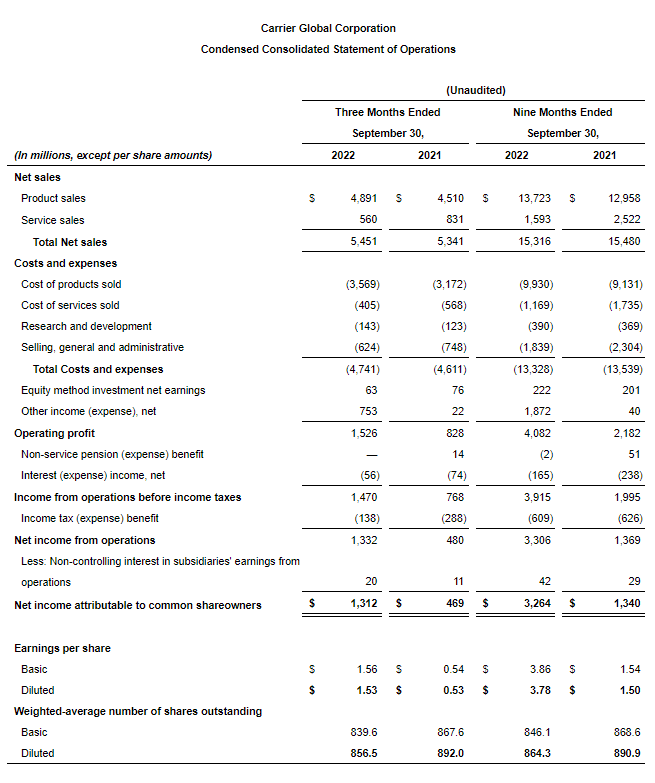

Third Quarter 2022 Results

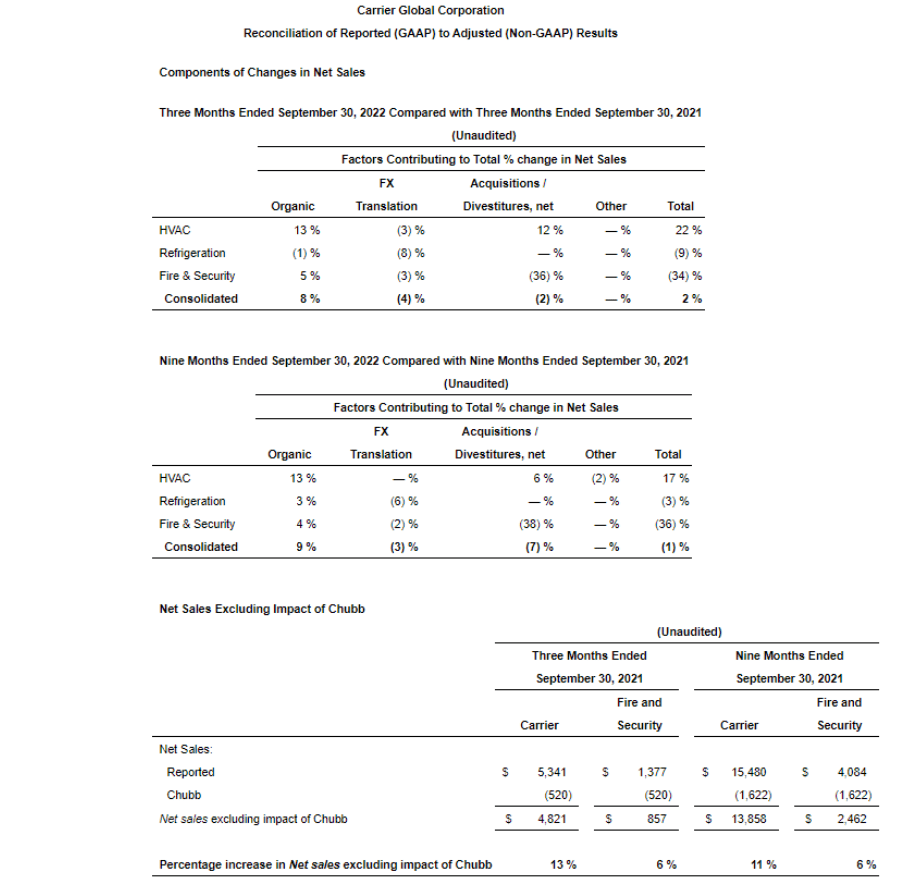

Carrier's third quarter sales of $5.5 billion were up 2% compared to the prior year, despite the impact from the Chubb divestiture and foreign exchange. Organic sales grew 8% while the Chubb divestiture reduced sales by about 10%, acquisitions contributed 8% and currency translation reduced sales by 4%. The Toshiba Carrier Corporation acquisition closed Aug. 1 and represented substantially all the sales growth from acquisitions in the quarter.

HVAC had another strong organic growth quarter with residential and light commercial sales up 12% and commercial HVAC growing 15%. Commercial HVAC continued to see strong order trends, up double digits for the seventh consecutive quarter. Refrigeration sales were down 1% organically due to supply shortages and a decline in Container sales. Organic sales for the Fire & Security segment were up 5%.

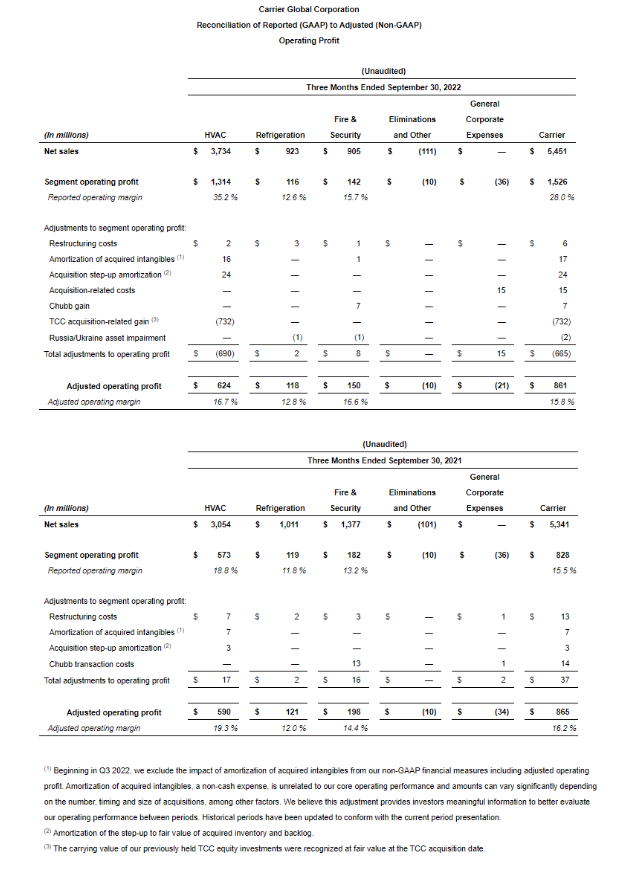

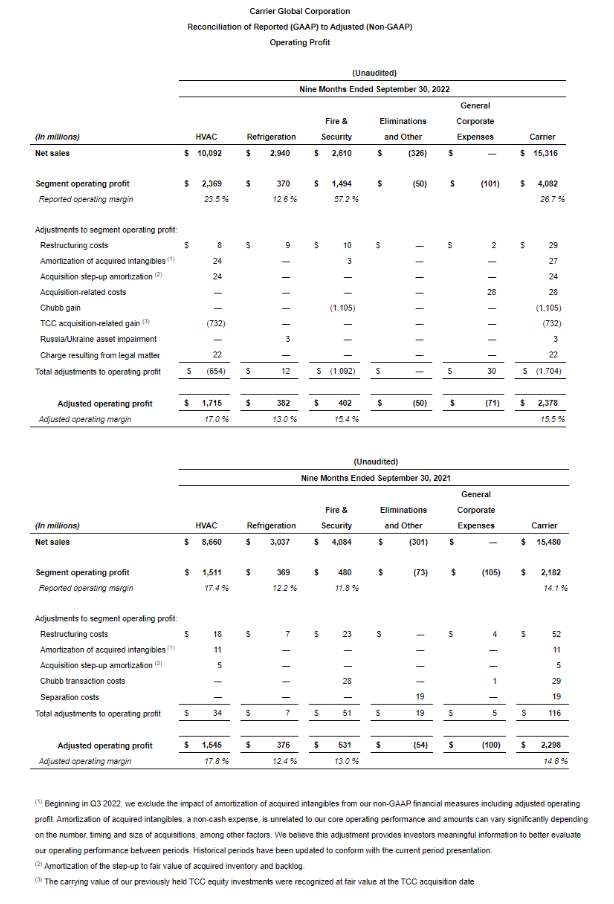

GAAP operating profit in the quarter of $1.5 billion was up substantially due to a $732 million gain related to the acquisition of Toshiba Carrier Corporation. Adjusted operating profit of $861 million was flat compared to last year. Strong price realization helped mitigate continued supply chain challenges. Price/cost remained positive in the third quarter across all three segments.

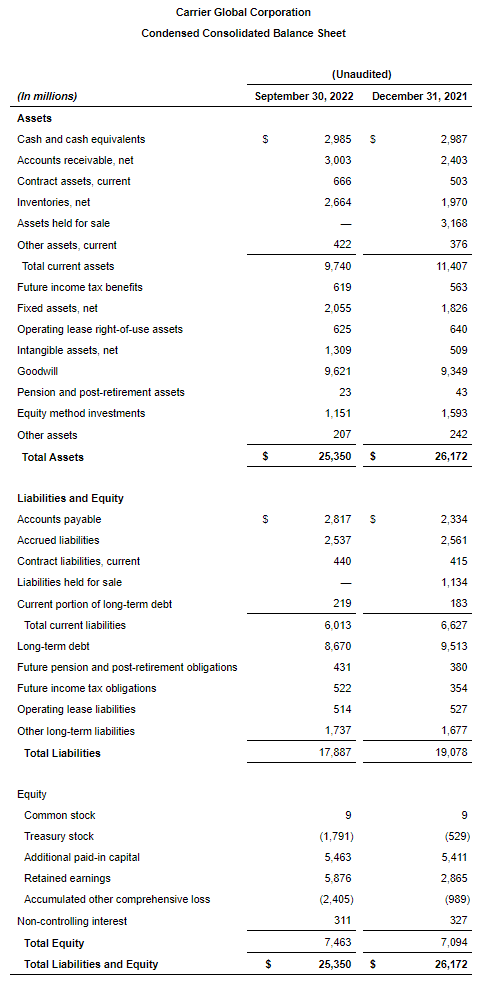

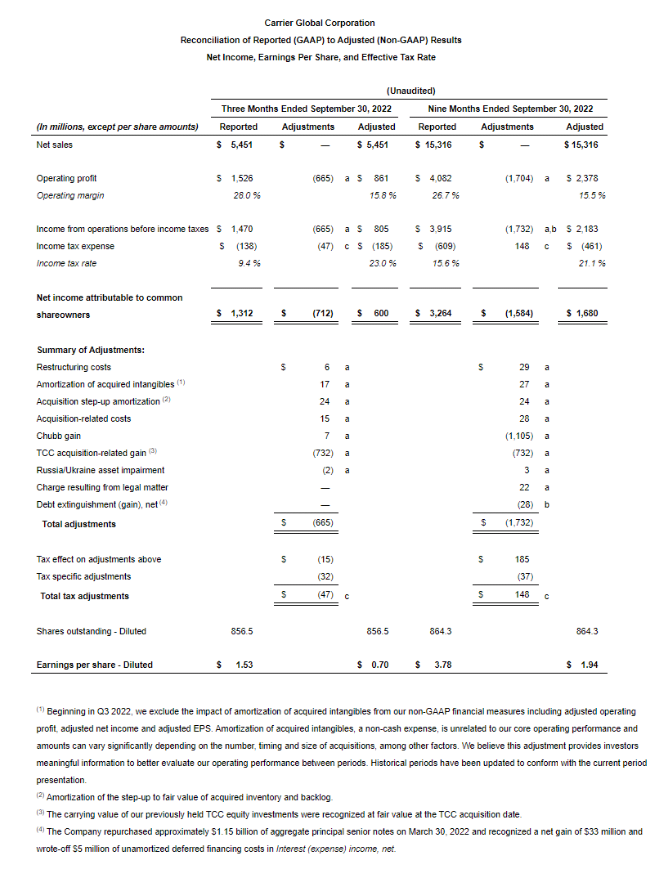

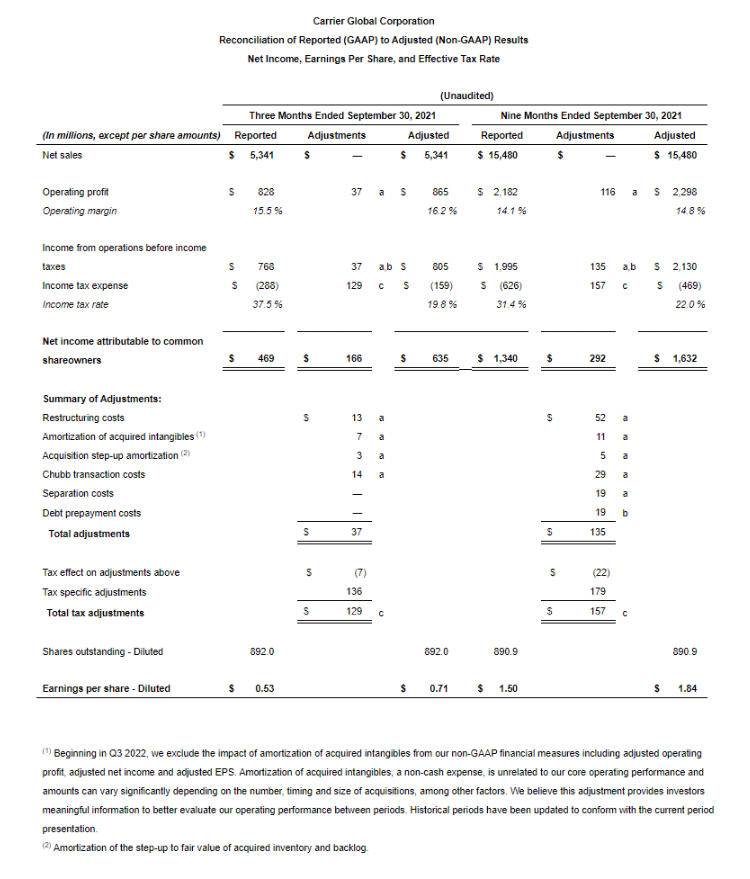

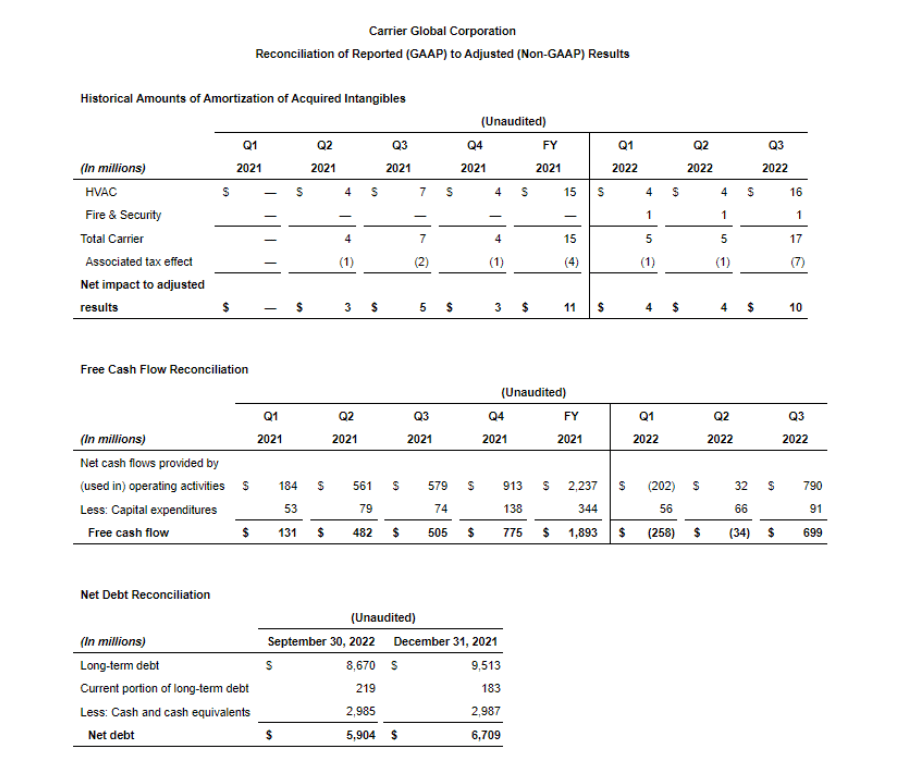

Net income was $1.3 billion and adjusted net income was $600 million. GAAP EPS was $1.53 and adjusted EPS was $0.70. Net cash flows from operating activities were $790 million and capital expenditures were $91 million, resulting in free cash flow of $699 million. Despite an improved free cash flow quarter, Carrier reduced full-year guidance from $1.65 billion to $1.4 billion as supply chain improvements are taking place later in the year than previously anticipated. During the third quarter, Carrier repurchased $247 million of its common stock.

On Oct. 25, 2022, Carrier Global Corporation's Board of Directors approved a $2 billion share repurchase authorization. Share repurchases will take place at the company's discretion in the open market or through one or more other public or private transactions, subject to, among other things, market conditions, share price, compliance with securities laws and regulatory requirements and other factors. The stock repurchase authorization has no time limit and may be modified, suspended or discontinued at any time. With the remaining portion of the prior authorization, Carrier currently has about $2.3 billion of repurchase authorization. This authorization is a key component of the company's capital allocation plans, which also includes acquisitions and dividends to help position the company for strategic growth and to generate attractive shareowner returns.

Updated Full-Year 2022 Outlook**

Carrier is announcing the following updated outlook for 2022.

Conference Call

Carrier will host a webcast of its earnings conference call today, Thursday, Oct. 27, 2022, at 7:30 a.m. ET. To access the webcast, visit the Events & Presentations section of the Carrier Investor Relations site at ir.carrier.com/news-and-events/events-and-presentations or to listen to the earnings call by phone, participants must pre-register at Carrier Earnings Call Registration. All registrants will receive dial-in information and a PIN allowing access to the live call.

Cautionary Statement

This communication contains statements which, to the extent they are not statements of historical or present fact, constitute "forward-looking statements" under the securities laws. These forward-looking statements are intended to provide management's current expectations or plans for Carrier's future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements can be identified by the use of words such as "believe," "expect," "expectations," "plans," "strategy," "prospects," "estimate," "project," "target," "anticipate," "will," "should," "see," "guidance," "outlook," "confident," "scenario" and other words of similar meaning in connection with a discussion of future operating or financial performance or the separation from United Technologies Corporation (the "Separation"), since renamed Raytheon Technologies Corporation. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, uses of cash, share repurchases, tax rates and other measures of financial performance or potential future plans, strategies or transactions of Carrier, the estimated costs associated with the Separation, Carrier's plans with respect to its indebtedness and other statements that are not historical facts. All forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. For additional information on identifying factors that may cause actual results to vary materially from those stated in forward-looking statements, see Carrier's reports on Forms 10-K, 10-Q and 8-K filed with or furnished to the U.S. Securities and Exchange Commission from time to time. Any forward-looking statement speaks only as of the date on which it is made, and Carrier assumes no obligation to update or revise such statement, whether as a result of new information, future events or otherwise, except as required by applicable law.

CARR-IR

|

Contact: |

Media Inquiries |

|

Ashley Barrie |

|

|

561-365-1260 |

|

|

Investor Relations |

|

|

Sam Pearlstein |

|

|

561-365-2251 |

|

SELECTED FINANCIAL DATA, NON-GAAP MEASURES AND DEFINITIONS

Following are tables that present selected financial data of Carrier Global Corporation ("Carrier"). Also included are reconciliations of non-GAAP measures to their most comparable GAAP measures.

Use and Definitions of Non-GAAP Financial Measures

Carrier Global Corporation ("Carrier") reports its financial results in accordance with accounting principles generally accepted in the United States ("GAAP"). We supplement the reporting of our financial information determined under GAAP with certain non-GAAP financial information. The non-GAAP information presented provides investors with additional useful information, but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. A reconciliation of the non-GAAP measures to the corresponding amounts prepared in accordance with GAAP appears in the tables in this Appendix. The tables provide additional information as to the items and amounts that have been excluded from the adjusted measures.

Organic sales, adjusted operating profit, adjusted operating margin, incremental margins / earnings conversion, earnings before interest, taxes and depreciation and amortization ("EBITDA"), adjusted EBITDA, adjusted net income, adjusted earnings per share ("EPS"), adjusted interest expense, net, adjusted effective tax rate and net debt are non-GAAP financial measures.

Organic sales represents consolidated net sales (a GAAP measure), excluding the impact of foreign currency translation, acquisitions and divestitures completed in the preceding twelve months and other significant items of a nonoperational nature (hereinafter referred to as "other significant items"). Adjusted operating profit represents operating profit (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items. Adjusted operating margin represents adjusted operating profit as a percentage of net sales (a GAAP measure). Incremental margins / earnings conversion represents the year-over-year change in adjusted operating profit divided by the year-over-year change in net sales. EBITDA represents net income attributable to common shareholders (a GAAP measure), adjusted for interest income and expense, income tax expense, and depreciation and amortization. Adjusted EBITDA represents EBITDA, as calculated above, excluding non-service pension benefit, non-controlling interest in subsidiaries' earnings from operations, restructuring costs and other significant items. Adjusted net income represents net income attributable to common shareowners (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items. Adjusted EPS represents diluted earnings per share (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items. Adjusted interest expense, net represents interest expense (a GAAP measure) and interest income (a GAAP measure), net excluding other significant items. The adjusted effective tax rate represents the effective tax rate (a GAAP measure), excluding restructuring costs, amortization of acquired intangibles and other significant items. Net debt represents long-term debt (a GAAP measure) less cash and cash equivalents (a GAAP measure). For the business segments, when applicable, adjustments of operating profit and operating margins represent operating profit, excluding restructuring, amortization of acquired intangibles and other significant items.

Free cash flow is a non-GAAP financial measure that represents net cash flows provided by operating activities (a GAAP measure) less capital expenditures. Management believes free cash flow is a useful measure of liquidity and an additional basis for assessing Carrier's ability to fund its activities, including the financing of acquisitions, debt service, repurchases of Carrier's common stock and distribution of earnings to shareowners.

Orders are contractual commitments with customers to provide specified goods or services for an agreed upon price and may not be subject to penalty if cancelled.

When we provide our expectations for organic sales, adjusted operating profit, adjusted operating margin, adjusted interest expense, net, adjusted effective tax rate, incremental margins/earnings conversion, adjusted EPS and free cash flow on a forward-looking basis, a reconciliation of the differences between the non-GAAP expectations and the corresponding GAAP measures (expected net sales, operating profit, operating margin, interest expense, effective tax rate, incremental operating margin, diluted EPS and net cash flows provided by operating activities) generally is not available without unreasonable effort due to potentially high variability, complexity and low visibility as to the items that would be excluded from the GAAP measure in the relevant future period, such as unusual gains and losses, the ultimate outcome of pending litigation, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, future restructuring costs, and other structural changes or their probable significance. The variability of the excluded items may have a significant, and potentially unpredictable, impact on our future GAAP results.

SOURCE Carrier Global Corporation